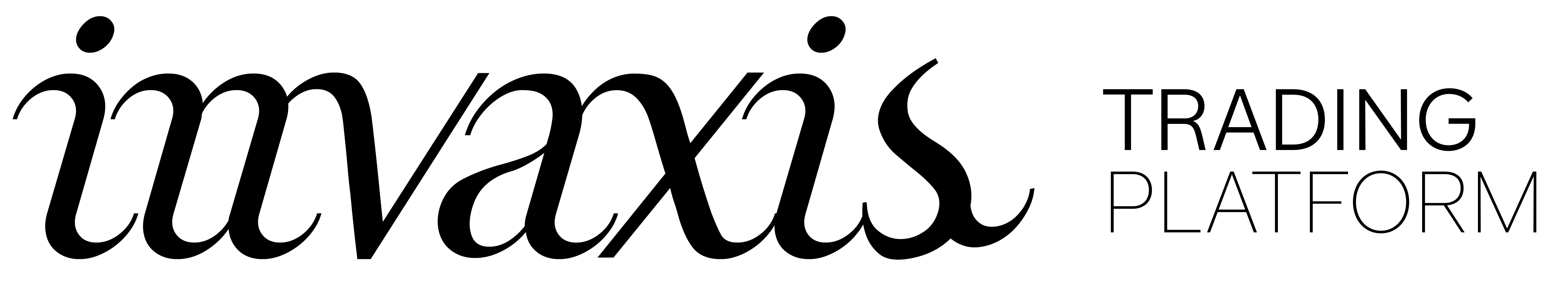

Oil prices posted their strongest opening to a year since 2014 on Tuesday, with crude rising to mid-2015 highs amid large anti-government rallies in Iran and ongoing supply cuts led by OPEC and Russia.

U.S. West Texas Intermediate (WTI) crude futures CLc1 traded flat at around $60.40 by 1200 GMT after hitting $60.74 earlier in the day, their highest since June 2015.

Brent crude futures LCOc1, the international benchmark, were also flat at around $66.80 after hitting a May 2015 high of $67.29 a barrel earlier in the day.

It was the first time since January 2014 that the two crude oil benchmarks opened the year above $60 per barrel.

“Growing unrest in Iran set the table for a bullish start to 2018,” the U.S.-based Schork Report said in a note to clients on Tuesday.

Iranian protesters attacked police stations late into the night on Monday as security forces struggled to contain the boldest challenge to the clerical leadership since unrest in 2009.

“Geopolitical risks are clearly back on the crude oil agenda after having been absent almost entirely since the oil market ran into a surplus in the second half of 2014,” Bjarne Schieldrop, chief commodities analyst at SEB, said, also citing Kurdistan and Libya.

Even without the unrest in Iran, which is a major oil exporter, market sentiment was bullish.

“Falling inventories globally and strong economic growth offset the restart of the Forties pipeline and the resumption of production following a pipeline outage in Libya,” said Jeffrey Halley, senior market analyst at futures brokerage Oanda in Singapore.

The 450,000 barrel per day (bpd) capacity Forties pipeline system in the North Sea returned to full operations on Dec. 30 after an unplanned shutdown.

Oil markets have been supported by a year of production cuts led by the Middle East-dominated Organization of the Petroleum Exporting Countries and Russia. The cuts started in January 2017 and are scheduled to cover all of 2018.

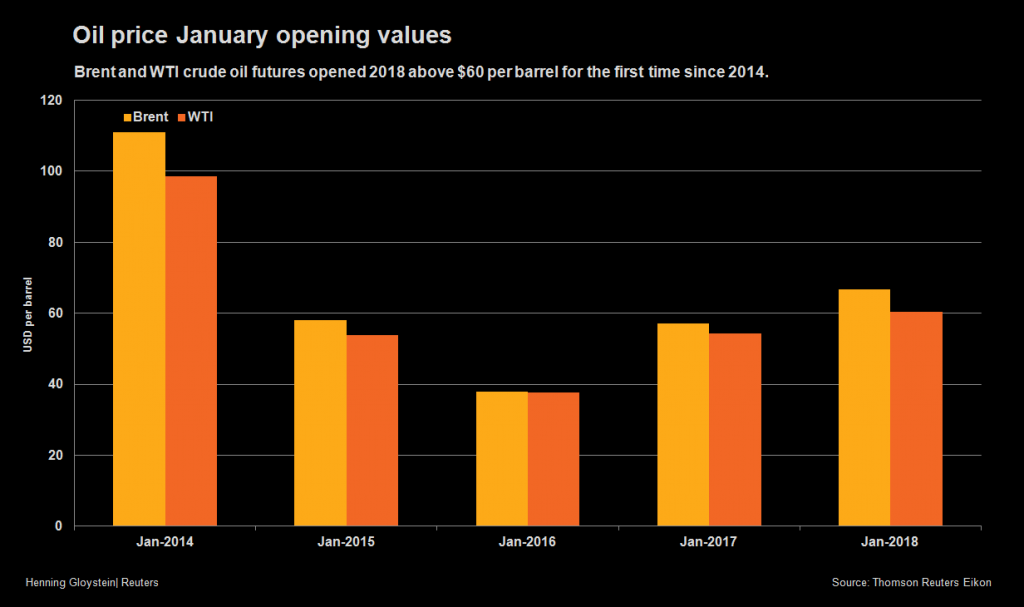

U.S. commercial crude oil inventories have fallen by almost 20 percent from their historic highs last March, to 431.9 million barrels.

Strong demand growth, especially from China, has also been supporting crude.

However, rising U.S. production, which is on the verge of breaking through 10 million bpd, is somewhat hampering the outlook into 2018.

However, rising U.S. production, which is on the verge of breaking through 10 million bpd, is somewhat hampering the outlook into 2018.

“We think U.S. tight oil production growth warrants close monitoring as it could spoil OPEC’s market-balancing efforts, pushing the market into surplus in 2018,” Barclays bank said.

U.S. oil production C-OUT-T-EIA, driven largely by onshore tight shale oil fields, has risen by almost 16 percent since mid-2016, to 9.75 million bpd at the end of last year.

Source: SINGAPORE/LONDON (Reuters), Bloomberg and others